By Mary Nebotakis, B. Eco, Dip. Financial Services, Managing Director, Natloans

An offset account can be a powerful financial tool to help homeowners reduce the interest they pay on their home loan while giving them access to their savings. If you’re looking for ways to save thousands of dollars in interest and pay off your mortgage sooner, this could be the solution for you.

In this article, we’ll cover what a 100% mortgage offset account is, how it works, and the key benefits it offers to homeowners.

What Is an Offset Account?

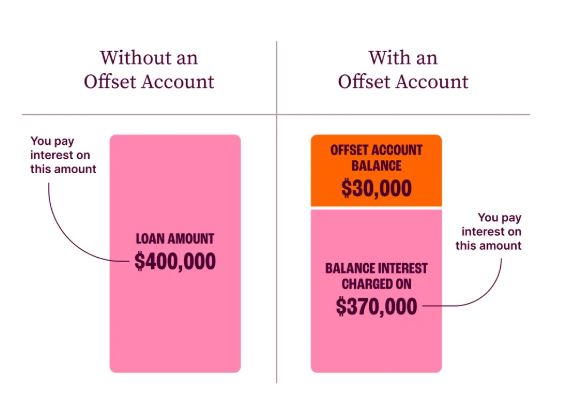

An offset account is a transaction or savings account that is linked to your home loan. The balance in your offset account directly reduces (or offsets) the amount of your mortgage on which interest is calculated. This means that instead of earning interest on your savings (which is often low and taxable), you reduce the amount of interest you pay on your home loan.

Unlike a partial offset account, which only offsets a portion of your home loan balance, a 100% offset account means every dollar in your offset account works to reduce the interest payable on your mortgage.

How Does an Offset Account Work?

Here’s how an offset account operates in simple terms:

1. Your home loan balance and offset account balance are linked. For example, if you have a $400,000 home loan and $30,000 in your offset account, interest is only charged on $370,000 instead of the full $400,000.

2. Interest is calculated daily. The amount in your offset account reduces the principal amount used to calculate interest on your loan each day, which can lead to significant savings over time.

3. You have access to your money. Unlike extra repayments on your mortgage, which can sometimes be difficult to withdraw, funds in an offset account remain accessible, just like a regular transaction account.

How Offset Accounts Work

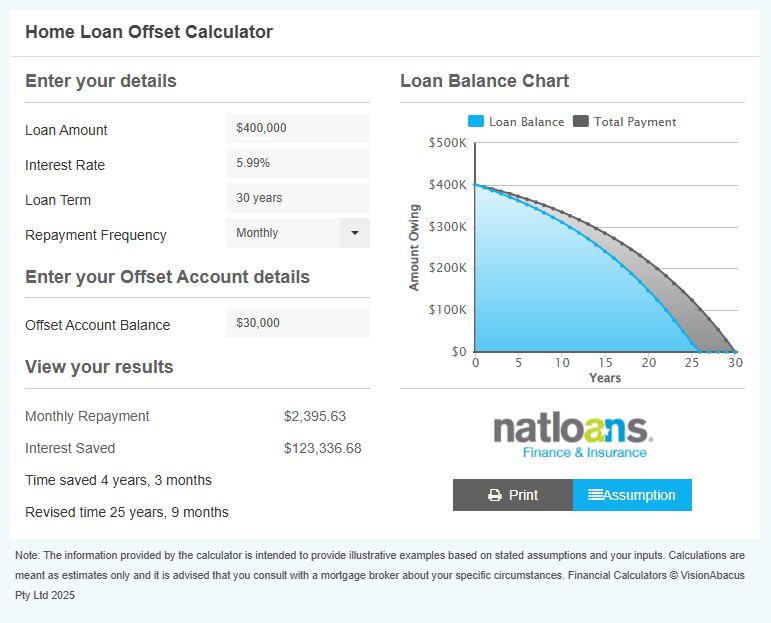

Effectively using can offset account can result in thousands of dollars in interest savings over the life of the loan and help you pay off your home loan sooner.

You can see in the example above just how much interest can be saved on a loan of $400,000.

With larger loans and larger balances in an offset account the potential savings are magnified.

Key Benefits of an Offset Account

1. Reduce Interest Payments

By lowering the loan balance on which interest is charged, you can save thousands of dollars over the life of your mortgage. The more you keep in your offset account, the less interest you pay.

2. Pay Off Your Home Loan Sooner

Since less interest is being charged, more of your repayments go towards reducing the principal balance, helping you clear your mortgage faster.

3. Access to Your Savings Anytime

Unlike making extra repayments directly to your home loan, which may require approval or a redraw process to access, funds in an offset account are always available when you need them.

4. Tax Efficiency

Interest earned on savings is taxable, but when you use a 100% offset account, you effectively ‘earn’ the same benefit in interest savings without being taxed.

5. Flexibility for Future Investments

An offset account allows you to keep savings aside for future investments or expenses while still maximising mortgage savings. This can be particularly useful if you plan to buy an investment property or start a business.

Are Offset Accounts Worth It?

An offset account is ideal for homeowners who have savings that they want to use efficiently without locking them into the mortgage. It is particularly beneficial for those who:

· Want to save on interest and pay off their loan faster

· Need easy access to their money for emergencies or future investments

· Have a variable-rate home loan (as offset accounts are often not available on fixed-rate loans)

· Are looking for a tax-effective way to manage their finances

If you’re unsure whether an offset account suits your situation, speaking with an experienced mortgage broker can help you assess your options.

Final Thoughts

An offset account is a smart financial strategy that can help you save thousands in interest and pay off your home loan sooner. By using your savings to reduce the interest charged on your mortgage, you can enjoy greater financial freedom while maintaining easy access to your funds.

Looking to explore how an offset account could work for you?

Contact Natloans today and let our expert brokers guide you towards a smarter home loan strategy.